Hello all,

I hope everyone is doing well and coping with the current situation to the best of your capabilities and holding on strong in good health.

With all the recent news and the upcoming downturn in the economy, I took a quick dive into how El Paso has done in real estate matters (Residential) in good times and bad times. I found a great research article on the El Paso housing market from a reputable Texas University. Here are some of the findings for you to see and reach your own conclusions.

Lets talk, I am here to help.

El Paso Real Residential Market

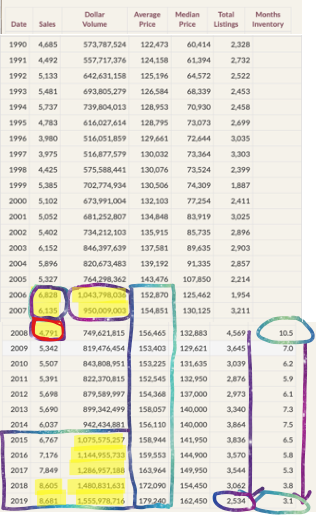

During the boom of the Real Estate Market in the US, El Paso indeed had a spike in volume of unit sales in 2006 and 2007 as well in average sales, beating the $1B Dlls mark. Then it dropped to levels of back when things were normal. So the El Paso market did not take a nose dive to levels worse to when things were normal. Market just went back to where things started in 2003.

As for Volume of sales in El Paso, 2008, the worst year of the crisis, the sales volumes compared to those of 2001 but the sales price remained strong and helped offset things.

Average Sales price NEVER dropped as a result of the Real Estate Crisis in El Paso according to these figures provided by this source. Very interesting finding.

As you can see, it took 6 years in El Paso to get back to the levels of the Real Estate Boom of the wild days of Real Estate in America, starting in 2015 things got back to those levels and has remained consistent until 2019.

If we did not have the current situation (CV), the trend in Volume is set to diminish as there is less inventory available to produce sales. So price would remain steady or increase.

The question right now is what will happen to sales volume? My thoughts are they could offset to slow down a bit, but still be confronted with LOW INVENTORY of property that is currently available in El Paso (Currently at 3 months down from 10 months in 2008).

So my personal take is that home prices will remain solid in El Paso as the above history has shown us and sales Volume will drop slightly to the 2015 levels, but it will be coupled with a low inventory. So the effect can somehow be netted out for the next 2 to 3 years (Pepe Guess) without hurting average sales price of homes.

A pressing question to ask is how hard will the upcoming economic downturn affect the El Paso Market, as quantity and quality of jobs translate directly to Real Estate Sales.

Lets keep El Paso Strong!

El Paso Residential Market

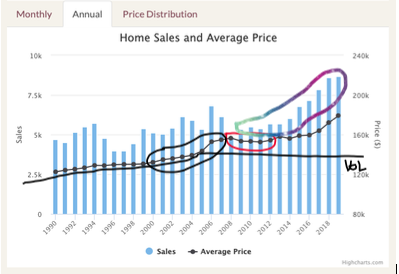

An interesting takeaway of this chart is that Sales volume never has taken a dive from the BASE LINE VOLUME, it does decrease Vs the previous year, but never against the VOLUME BASELINE.

In terms of the Average Price, we do see that prices go down Vs previous years , but stabilized to the Pre Boom Years of 2004 and started climbing in 2014/2015. So this could be an indicator of what is to come. My personal take.

Source

![]()

El Paso Residential Market

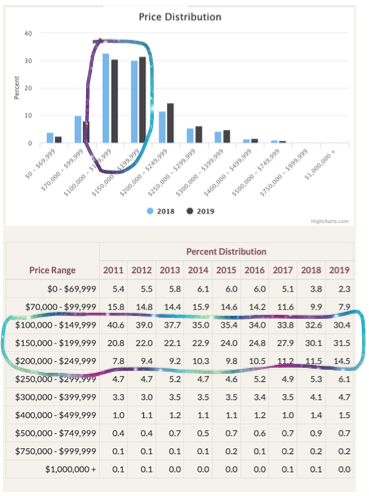

This table helps us see that we are moving away from the cheaper houses little by little, but the bulk of things in El Paso are still between $100K and $200K. So this table can help you to see where is where you want to do your FLIPS or Rental Investments long term, as this is what El Pasoans are mostly buying (76.40%).

I hope these loose and rapid thoughts help give you some context into how the El Paso market does when the rest of America is both in trouble and good times.

Lets talk if you find some interesting facts or observations that I overlooked. I have not drunk enough coffee yet.

Saludos

PPR

Source of information

![]()

Speak Your Mind